Continuous liquidity for greater business flexibility.

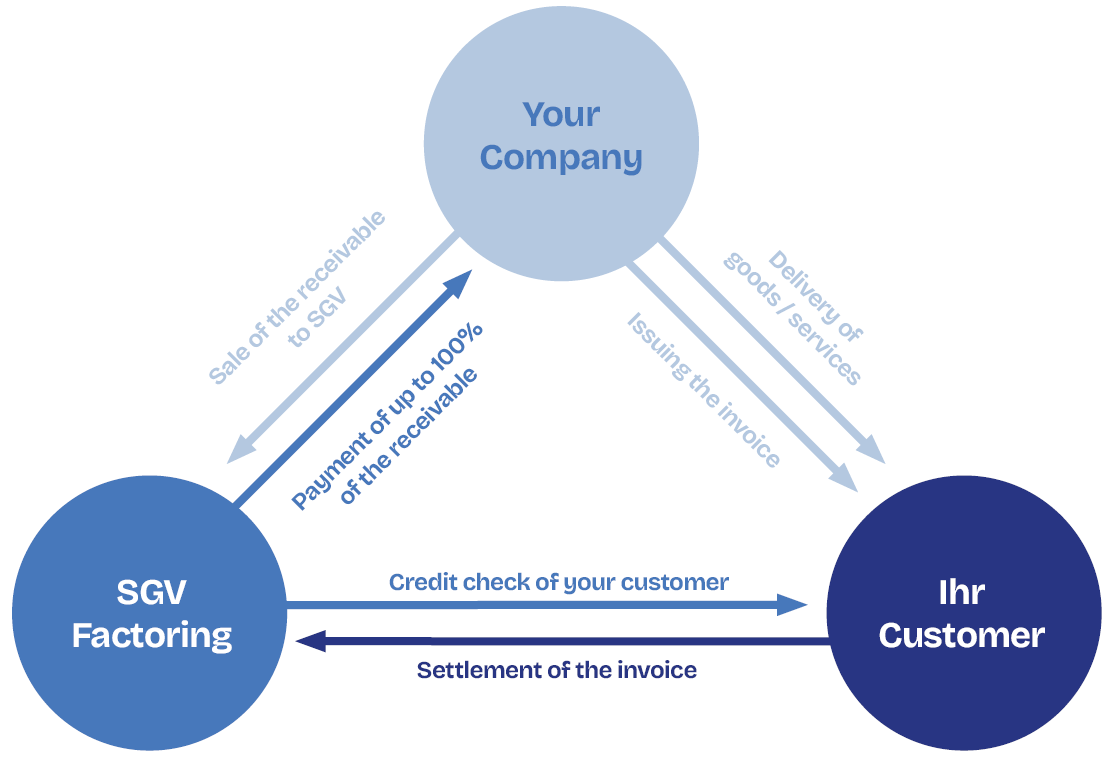

With classic full-service factoring, you, as the supplier or service provider, are the initiator of the factoring process. You sell your outstanding receivables (invoices to your customers for goods delivered or services rendered) to SGV Factoring. We pay the invoice to you within 24 hours. Your customer transfers the invoice amount to us upon maturity.

In the background, we take over the accounts receivable management, check credit ratings, monitor incoming payments and take care of the dunning process. You save time, gain planning security and keep an eye on your financial flows at all times.

SGV’s all-round carefree package

Factoring is a flexible, bank-independent concept for corporate finance. The ongoing sale of receivables to the factor ensures liquidity, protection against bad debt losses and relief in accounts receivable management.

We will inform you about the solvency of your future contractual partner before the contract is signed.

It’s that simple:

- You request a limit for your potential contractual partner from us. With our limit commitment, you can approach the business with peace of mind.

- The risk of your customer’s insolvency is completely transferred to us. We therefore offer effective protection against impending insolvencies of your customers and the associated bad debt losses.

- Increase your liquidity by selling us your open receivables.

- Become independent of loans or overdrafts from your bank.

Every business carries the risk of payment defaults, which depend on the industry, the typical contractual arrangements, and the company. We calculate these risks individually for your specific case. Within the approved limit, your receivables are secured, and you can confidently conclude a supply contract with an open payment term.

We handle all aspects of your invoicing – including dunning, debt collection, and protection against payment defaults. As part of accounts receivable management, we monitor your customers’ payments and, if necessary, initiate dunning and debt collection procedures.

Higher liquidity through assigned receivables secures you better conditions with banks and better opportunities with investors.